Mastering Forex Trading Your Guide to Online Trading Courses

Mastering Forex Trading: Your Guide to Online Trading Courses

In today’s fast-paced financial landscape, mastering the art of Forex trading has become a sought-after skill for many aspiring traders. With the advent of online platforms, learning how to navigate the complexities of currency markets has never been easier. Enrolling in a comprehensive online forex trading course Best Kuwaiti Brokers online Forex trading course can put you on the path to success, equipping you with the knowledge, skills, and strategies necessary to thrive in this competitive arena.

Understanding Forex Trading

Forex trading, or foreign exchange trading, involves buying and selling currencies in a global marketplace. It’s a decentralized market, meaning trades happen over-the-counter rather than on centralized exchanges. The Forex market is the largest financial market in the world, with trillions of dollars traded daily. Participants include governments, institutions, corporations, and individual traders.

The Benefits of Online Forex Trading Courses

Enrolling in an online Forex trading course has numerous benefits. Here are a few:

- Flexibility: Study at your own pace and convenience.

- Access to Resources: Learn from experienced traders and gain access to various trading tools.

- Networking Opportunities: Connect with fellow learners and professionals in the Forex community.

- Updated Information: Stay current with the latest market trends and strategies.

What to Look for in a Forex Trading Course

Choosing the right online Forex trading course is crucial for your learning journey. Consider the following factors:

- Course Content: Ensure it covers the essentials of Forex trading, including technical and fundamental analysis, risk management, and trading psychology.

- Trainers’ Experience: Research the instructors and their backgrounds to ensure they have substantial experience in Forex trading.

- Student Reviews: Check testimonials and reviews from previous students to gauge the effectiveness of the course.

- Cost: Consider your budget and compare the costs of different courses. Remember, a higher price doesn’t always guarantee better quality.

Essential Topics Covered in Forex Courses

While the curriculum may vary between courses, most comprehensive online Forex trading courses will cover the following essential topics:

- Forex Market Mechanics: Understanding how the market operates, including market hours and currency pairs.

- Chart Analysis: Learning to read and interpret charts to make informed trading decisions.

- Indicator Usage: Familiarization with technical indicators that aid in predicting price movements.

- Trading Strategy Development: Crafting and testing your own trading strategies based on your risk tolerance and market analysis.

- Risk Management: Learning how to manage your risk effectively to protect your capital.

The Importance of Practice

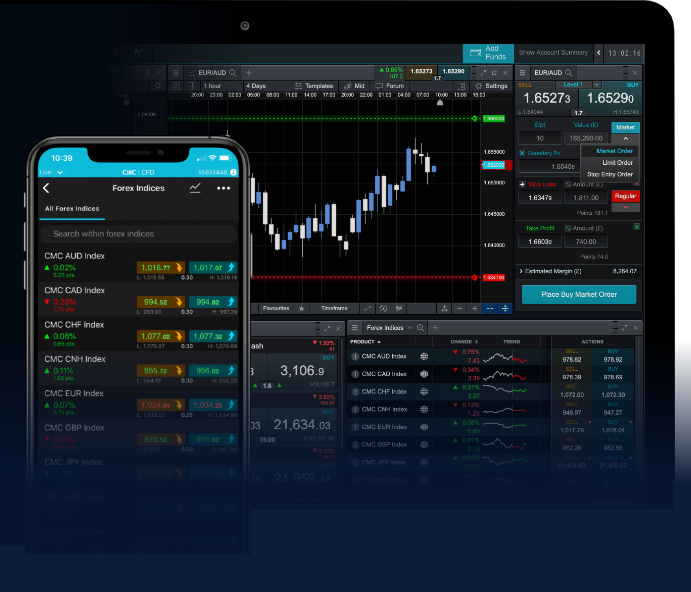

One of the key advantages of online Forex courses is the availability of demo accounts. These accounts allow you to practice trading without risking real money. This hands-on experience is invaluable as it helps you to:

- Apply theoretical knowledge in real-time.

- Understand trading platforms and tools.

- Refine your trading strategies without financial pressure.

Choosing the Best Online Forex Trading Course

Begin your search for the right course by researching platforms that specialize in Forex education. Some popular platforms include:

- Udemy: Offers a wide range of Forex courses at various levels.

- Coursera: Partners with established universities to provide accredited courses.

- Forex Academy: Dedicated to Forex education with structured courses and mentorship.

Be sure to compare course features, durations, and student support before making a decision.

Final Thoughts

Starting your journey in Forex trading can be daunting, but with the right online course, you can gain the knowledge and skills necessary to navigate the market confidently. By investing in your education and learning from experienced traders, you will increase your chances of success in this exciting financial niche. Remember, consistent practice and a commitment to continuous learning are key to becoming a successful Forex trader.

In conclusion, an online Forex trading course not only provides you with essential skills and knowledge but also helps you to connect with a community of traders. Whether you are a complete novice or seeking to sharpen your skills, finding the right course can significantly impact your trading journey. Take your time to research and choose wisely, as the right education will pave the way for your future success in the Forex market.